Our solution automates the entire process from expense claim to reimbursement, while complying with internal control and validation rules.

With our business process acceleration approach, you can now maximise your ability to manage expense claims. No more delays and inefficiencies in handling administrative tasks.

Vertical Expense offers a complete configuration framework with advanced expense audit workflows.

Thanks to fine-tuned integration of rules and spending limits, the solution guarantees a high level of internal and external compliance.

Thanks to its flexible configuration options, the Vertical Expense solution allows you to define as many approval workflows as you wish in line with your internal organisation.

From approving mission orders to employee travel, add the levels of approval required by population type, project team or cost centre.

You can also add parallel validation circuits depending on the object to be validated : vehicles, RIBs, insurance.

Take a step towards more reliable and compliant management with our dedicated solution :

Our advanced features help you to identify and correct potential inconsistencies, ensuring greater compliance with the rules in force.

Reclaiming VAT allows you to reduce your company’s expenditure while putting money back into your budget.

Our intelligent solution automatically identifies and collects the different levels of VAT payable on business expenses.

We then extract the data in the format you require for use in your accounting software to help you recover VAT quickly.

An integrated expense rule allows you to automatically configure reimbursement limits and conditions (e.g. hotel, meals, mileage allowances). The software applies these rules in real time to ensure compliance.

Yes, modern software allows you to define different rules depending on teams, budgets or hierarchical levels. This strengthens internal control while allowing for flexibility.

The software automatically assigns each expense claim to the appropriate approver, according to the defined organisation (manager, HR, finance). The approval processes can be simple or multi-level, adapted to the size and structure of the company.

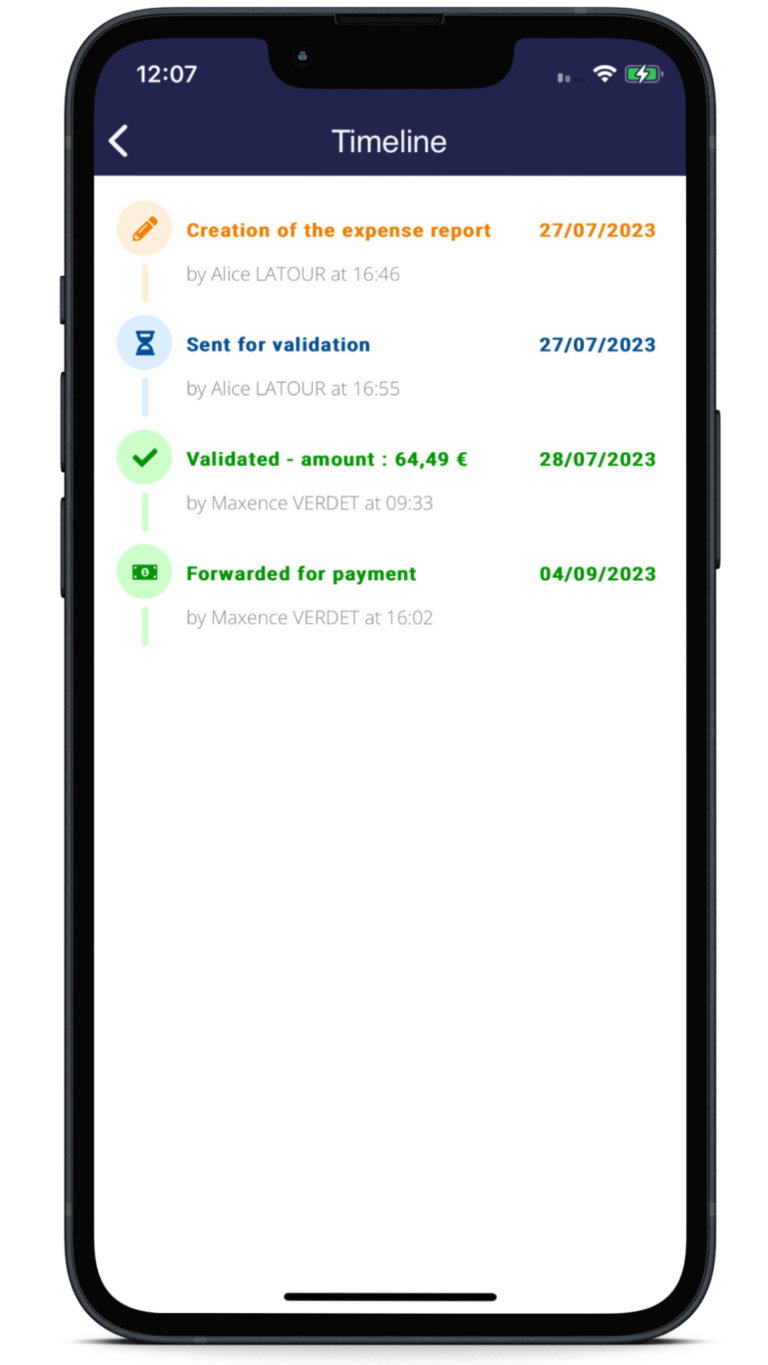

It speeds up expense processing, reduces reimbursement delays and ensures decision traceability. Each validation is logged for greater transparency and compliance.

Using OCR and AI, the software compares receipts (date, amount, supplier) and automatically flags potential duplicates. The user or validator can then confirm or correct.

Yes, modern software sends a notification as soon as an expense exceeds the defined limits. This allows for upstream control, before validation or reimbursement.

The software automatically identifies deductible VAT amounts on receipts (hotels, meals, transport) and generates a compatible accounting export. This prevents oversights and optimises the company's cash flow.

No, only certain business expenses are eligible (hotels, fuel, meals, subject to conditions). The software applies the tax rules in force to retain only recoverable amounts.

"The team in charge of reimbursements was scanning 10,000 expense claims a year. They will now be able to devote themselves to higher value-added tasks and provide better support to our users. The tool is really easy to use and very intuitive."

François Couteux,

Chef du service fonctionnel de la direction des ressources humaines de la Région Bretagne