Thanks to its advanced features and powerful algorithm, our solution adapts to your ecosystem and refocuses your staff on their core business.

56% of employees find the process of reimbursing business expenses long and difficult.

The Vertical Expense application enables your staff to use a powerful and intuitive tool, reducing the amount of time they spend entering data. The tool accompanies them from start to finish on their business trips.

A simple photo of the receipt is all it takes to complete the expense and attach it to the expense claim.

Our intelligent OCR, based on character recognition, detects important information such as the date, amount, currency, VAT and type of expense and automatically integrates it into each field for immediate completen

Say goodbye to paper ! Expense claims, receipts and supporting documents can now be processed completely electronically.

All business expenses are digitised and stored in a digital ‘safe’ to help you manage costs more effectively and save time on expense management.

Supporting documents are archived for a legal period of between 6 and 10 years, ensuring compliance with current legislation.

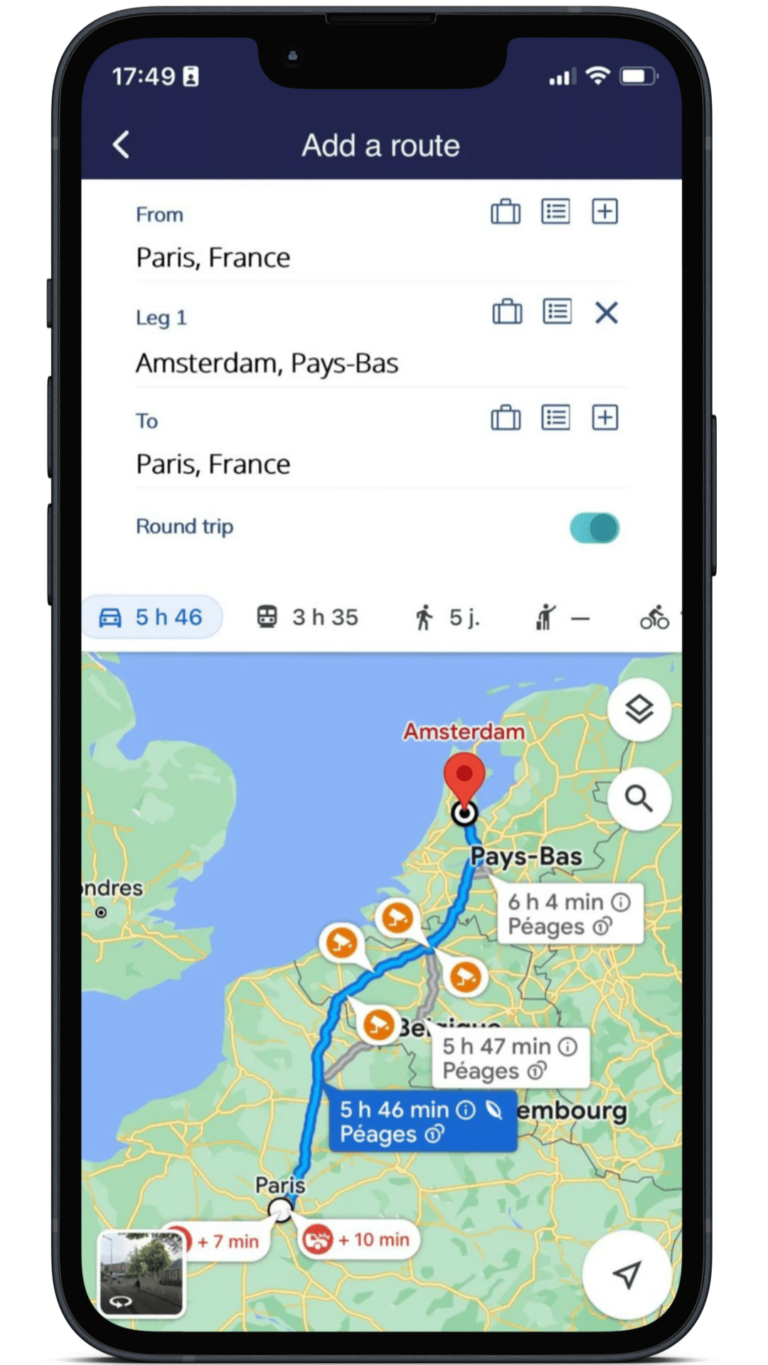

The application automatically calculates the distance of business journeys and the associated mileage allowance, in full compliance with the reference scale.

This reduces the risk of data entry errors, provides precise visibility of the status of expenditure and enables it to be managed proactively.

Your employees have a clear view of the amount reimbursed, calculated on the basis of the scales applied and the vehicle’s engine.

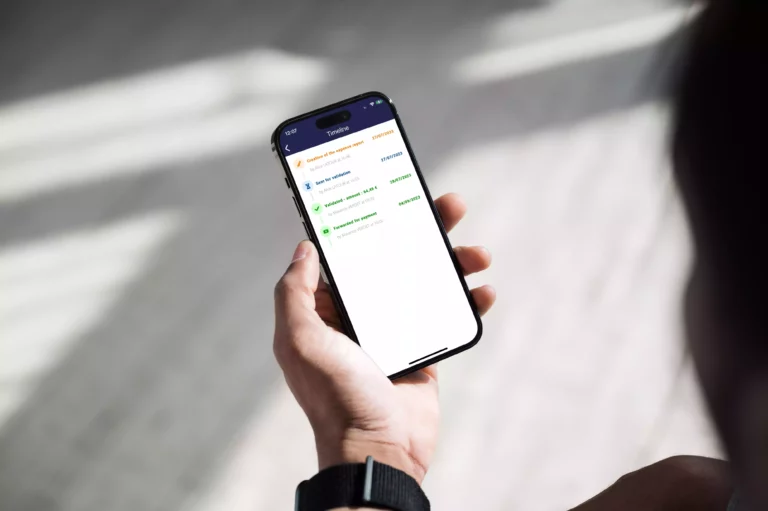

Vertical Expense simplifies expense management, allowing you to monitor the progress of expense claims in real time.

Our interactive timeline allows you to follow every step of the way: from validation to reimbursement of expense claims.

With Vertical Expense, you no longer have to worry about queries and reminders, you can be sure of complete, reassuring visibility at all times.

Smart scanning uses OCR (optical character recognition) to automatically read information from a receipt (amount, VAT, date, currency). This eliminates manual entry and significantly reduces errors.

Reliability depends on the quality of the supporting document. Modern software achieves over 95% recognition, and the user can make corrections if necessary before validation.

It is a certified digital archiving method (NF203) that guarantees that a dematerialised document has the same legal value as a paper document.

Yes, provided they are archived in accordance with evidential standards. In the event of an audit, the company may present digital receipts as valid proof.

It automatically applies the URSSAF tax scale or the company's tax scale depending on the type of vehicle and the distance declared. This prevents calculation errors and ensures compliance.

Yes, you must indicate the route (often via an integrated mapping tool). The software then generates the calculation and associates it with a digital receipt.

By centralising expense reports, automating checks and validating requests more quickly, the software reduces the time it takes to reimburse employees.

Yes, some software integrates with payroll or treasury systems to automatically trigger reimbursement once the invoice has been approved.

"As HR managers, employees are my customers. We need to facilitate their employee experience with a user-friendly, mobile tool. Vertical Expense is the perfect example of successful integration and unanimous adoption."

Nathalie Georges,

Direction Générale Adjointe des richesses humaines et expériences collaborateurs d'Aésio Mutuelle